- Published

- 16 Feb 2026

We are proud to announce the launch of our improved affordability solution – Basiq Insights. Leveraging a variety of data sources including Open Banking, our uplifted Insights solution offers a holistic approach to financial data analysis and decision making in the lending industry by bringing together the power of Basiq’s API with the simplicity of a no-code dashboard.

In today’s rapidly evolving financial landscape, lenders face a multitude of challenges that can hinder their efficiency and effectiveness. From the intricacies of regulatory compliance to the need for technological agility, these challenges demand innovative and adaptable solutions. Basiq Insights emerges as a pivotal tool in addressing these complexities. Let’s explore some of the key challenges in the lending space and how Basiq Insights provides effective solutions:

Powerful APIs for bespoke decisioning

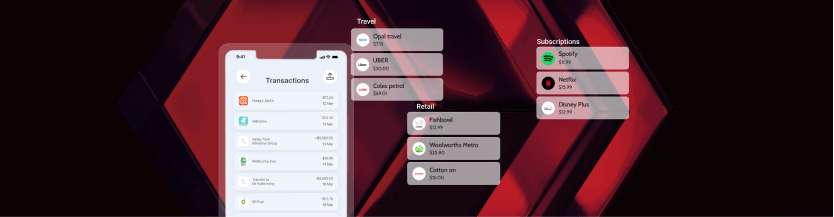

Basiq’s API forms the backbone of the affordability solution, allowing lenders to delve deep into financial data with enriched transaction details, ensuring precise and reliable insights tailored to their specific needs.

It is an unparalleled tool, empowering you to create bespoke decision making for your customers that align with your specific use case. It boasts the most comprehensive library of data points, metrics and categories available in the market, enabling you to go beyond using templated reports from conventional providers.

Basiq’s No-Code Dashboard – empowering teams beyond development

The no-code dashboard revolutionises the experience for non-developer teams. Designed for seamless integration with the API or as an independent solution, it simplifies interaction with Basiq’s robust reporting API. The dashboard provides access to data aggregation, enrichment, and insights, all without requiring specialised coding skills or the development of custom applications. Its user-friendly interface bridges the gap between complex data handling and operational ease, enabling you to focus on creating value for your end users.

Across the Basiq API and Dashboard you can access a range of features and capabilities.

Basiq Insights stands as a beacon of innovation in the financial sector, particularly in the realm of lending. Seamlessly blending the technological prowess of its API with the accessibility of a no-code dashboard, this solution not only meets the current demands of the lending industry but also anticipates its future needs.

Basiq Insights is not just a tool but a comprehensive solution, tailored to meet the diverse needs of the modern lending landscape. With its array of advanced features, it offers unparalleled depth and breadth in financial data analysis and reporting across its API and No-Code Dashboard solutions. Here’s a look at some of the key features that make Basiq Insights a leader in its field:

The robust features underscore Basiq’s commitment to driving efficiency, accuracy, and user satisfaction. More than just a tool, Basiq Insights is a strategic ally for lenders, empowering them with the data and insights needed to navigate the complexities of the financial landscape. With a forward-thinking approach to data privacy, regulatory compliance, and user experience, Basiq Insights is setting a new standard for consumer affordability solutions. As the lending industry continues to evolve in this digital age, Basiq Insights is undoubtedly leading the charge, paving the way for smarter, faster, and more customer-centric lending practices.

Embrace the future of lending with Basiq Insights, where innovation meets efficiency and customer satisfaction.

Important Information: This article has been prepared by Basiq Pty Ltd (ABN 95 616 592 011) (Company), and was originally published on 5 December 2023 on www.basiq.io. Information is current as at the publication date, and the Company has no obligation to update or correct this article. The information contained in this article is of a general nature and is not intended to address the objectives or needs of any particular individual entity, and should not be regarded in any manner as advice. To the extent permitted by law, the Company and its related bodies corporate will not be liable for any errors, omissions, defects or misrepresentations in the information in this article or for any loss or damage suffered by persons who use or rely on such information (including for reasons of negligence, negligent misstatement or otherwise. © 2023 Basiq Pty Ltd