- Published

- 16 Feb 2026

Investing can seem like a scene out of The Wolf of Wall Street. The stakes are high, the cash is thrown around like Monopoly money, and stock levels rise and fall like a rollercoaster. It’s loud, it’s fast and only a handful of people know the rules.

But this boys’ club vision of investing isn’t the only option. While getting into the market used to come with a big initial investment, things are changing. New fintechs are launching and listening to what today’s investors care about.

Research from the Responsible Investment Association Australasia (RIAA) reveals four in five Australians expect their money to be invested responsibly by super funds, banks and other financial institutions. Interestingly, 17% are already putting their money where their mouth is and investing in ethical products.

That’s exactly what fintech Blossom is committed to delivering. Blossom helps everyday Australians access fixed-income assets to watch their savings grow while knowing they’re putting their money into companies that are doing good.

We sat down with Blossom’s Co-Founder, Gaby Rosenberg to find out how Blossom approaches ethical investing and how they’re helping Australians reach their savings goals faster.

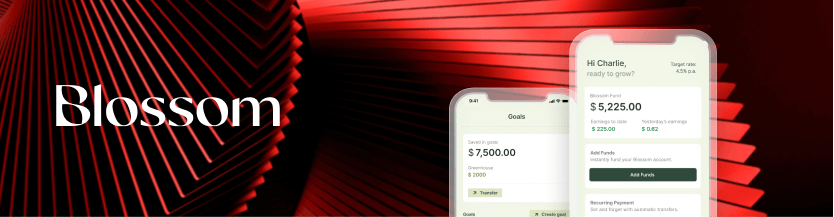

Blossom is an investing app helping everyday Australians access fixed-income assets to grow their savings.

Typically, fixed-income assets (which include corporate bonds, government bonds mortgage-backed securities, and more) have been only accessible to financial institutions, super funds, hedge funds, and high-net-worth individuals.

But, Blossom flips things on their head by allowing anyone to get started with no minimum investments, low fees and flexible withdrawals.

“Blossom democratises access to fixed income so that Aussies can grow their savings faster, easier and smarter,” explains Gaby.

Blossom is an app for everyone. Rosenberg herself says the whole point of the app is to level the playing field to help everyday Australians take control of their savings.

Unsurprisingly, the Blossom app has already been a big hit with millennial investors, many of which care about where they’re putting their money. Interestingly, users aged 55+ are a growing cohort of users for Blossom, too. While it’s been a surprise to the team, Blossom is thrilled to be helping all Australians diversify their investments and add alternative assets to their portfolio mix.

“I think that the female demographic is really seeing themselves in what we’re trying to build from a responsible investment perspective… that’s becoming more and more important to this demographic,” tells Gaby.

Blossom makes it easy for users to get started and grow their wealth.

It was during COVID when the idea for Blossom started to form. After trying to get a handle on her own personal finances, Gaby started considering new ways to make her money work harder.

Luckily enough, she had a bunch of finance professionals in her family who would bring a lot of innovative ideas to the dinner table.

One week, fixed income was brought up and piqued her interest.

“It was an extremely attractive asset class for me, but something that I hadn’t made any investments in before. I felt immediately pressed out of the market and I decided that this was likely an opportunity that would be attractive to some of my friends, and some of my colleagues.

Then I started thinking about ways to tap into the trend of micro-investing by democratising access to new asset classes, like fixed income.”

Since launching in 2021, Blossom now boasts over 8,600+ customers and has $36 million (and counting) under management.

Australian consumers are increasingly looking for sustainable, environmentally friendly and ethical products. In fact, 1 in 5 Millennials and Gen Xers are investing responsibly and making choices based on environmental and social issues.

But, companies are increasingly engaging in the practice of greenwashing.

Last year Australian Competition & Consumer Commission (ACCC) launched an investigation into misrepresentative environmental claims across a bunch of business sectors and the Australian Securities and Investments Commission (ASIC) is actively monitoring the market, taking action against greenwashing.

Gaby says responsible investing is at the heart of their brand with strict exclusion criteria around who they invest in (along with specific exclusions for industries like coal, oil, gas, child slavery, and weapons).

“Responsible investing is absolutely at the heart of our investment management philosophy and we care a lot about it at Blossom. Doing good for the world and the environment and delivering strong financial returns for investors is a moral and financial imperative for us,” explains Gaby.

It’s been a financially difficult time for many Australians with the annual inflation rate rising to 7.8% (the highest level since 1990). That means it has never been more important to build a healthy savings buffer and make our money work harder for us.

Blossom helps users grow their savings, currently offering 4.5% p.a. targeted returns.

To date, Blossom’s tools have helped real Australians reach big milestones, from saving up a deposit for their first home to growing a ‘rainy day’ fund and even preparing to start a family, too.

“We know that saving money starts with a plan, which is why we have savings calculators and savings goals built within the functionality of the app. Users can use Blossom to really build that plan as well as track and reach those savings goals,” reveals Gaby.

Gaby says Blossom has gained a lot of value from Basiq, specifically around accessing customer data to enable some of the app’s most important features.

“We take data from Basiq and we use it to enable our auto grow feature, which basically helps our customers round up their virtual spare change. With our auto-grow feature, users have really small and easy access to diversified portfolios like the Blossom fund. It gives customers an awesome way to get on top of their financial habits, build better financial habits and start investing in small and consistent ways.

We needed to access consented customer data across multiple institutions. Open Banking through Basiq was the best way for us to access that. It actually offers us strong fraud protection, which is not something that I hear people speak to often.

It helps us put protections in place to keep our customer’s savings, their accounts, all their data and information safe from financial crime, so that was a key piece of value we gained from Basiq,” tells Gaby.

A high level of support and a hands-on onboarding approach were big priorities for Gaby and the Blossom team, which is what attracted them to use Basiq as their Open Banking provider.

“We’ve had nothing short of an excellent experience so far. Every interaction we’ve had with the team from the moment of signing until we finished the signup and integration was professional, helpful, and super informative. Basiq is hyper-focused on Australia… they’re building a product that’s fit for purpose for us and the Australian market.

In terms of coverage, they offer the best Aussie bank coverage for Blossom to service our customers all over Australia (inclusive of customers who are banking with smaller institutions, too).”

Gaby says democratising access to fixed-income assets for Australians is Blossom’s main goal, along with helping users reach their financial goals.

The Blossom team are also working hard on a tonne of new features, including new investment offerings which will be announced later this year. Plus, they’re rolling out Blossom For Kids and working on a white-labelled partner offering called Blossom-as-a-service.

“This will allow partners of Blossom to unplug the Blossom app and plug in their own front end so that they can white label blossom and make it look and feel as they please and distribute it to their existing audience,” shares Gaby.

Important Information: This article has been prepared by Basiq Pty Ltd (ABN 95 616 592 011) (Company), and was originally published on 31 March 2023 on www.basiq.io. Information is current as at the publication date, and the Company has no obligation to update or correct this article. The information contained in this article is of a general nature and is not intended to address the objectives or needs of any particular individual entity, and should not be regarded in any manner as advice. To the extent permitted by law, the Company and its related bodies corporate will not be liable for any errors, omissions, defects or misrepresentations in the information in this article or for any loss or damage suffered by persons who use or rely on such information (including for reasons of negligence, negligent misstatement or otherwise. © 2023 Basiq Pty Ltd