- Published

- 16 Feb 2026

The Consumer Data Right (CDR) in Australia has recently undergone significant updates, especially with the introduction of Business Consumer Disclosure Consent. This new form of consent broadens the horizon for business consumers, allowing them to share their CDR data with a wider array of service providers, beyond the traditional “Trusted Adviser” list. This list initially included professionals such as accountants and lawyers but now extends to include service providers like bookkeepers, finance brokers, insurance brokers, and business coaches.

If you want to know more about the changes have a read of our previous blog here.

Getting straight to the point, the new CDR updates include:

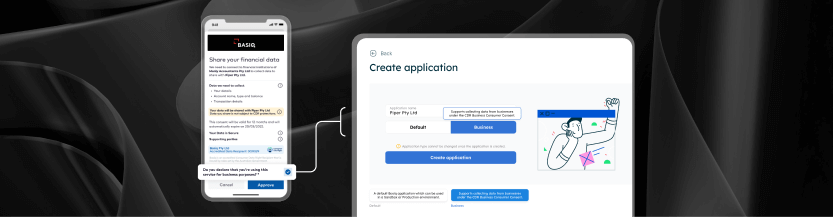

The recent updates to the CDR, present a new opportunity for businesses to engage in data sharing. Basiq’s consent UI has been enhanced to accommodate these changes, ensuring that businesses can leverage our platform to share financial data with a broader array of service providers. This enhancement is integrated into our existing consent UI, ensuring that the user experience remains consistent and intuitive.

So let’s take a closer look

The service provider Piper is wanting to collect business account details from a customer so they can offer a better service for their customer. They have integrated with Basiq to use their consent UI solution to allow their business customers to securely connect and share their bank account details in order to speed up this process and reduce manual processing.

The Basiq consent UI simplifies the complex and verbose consent flow established by the ACCC and DSB CX (Customer Experience) guidelines. Our focus has always been to strike the perfect balance between compliance with the Consumer Data Right (CDR) regulations and offering an intuitive, user-friendly experience that maximises conversion rates. It aims to:

The updates to Australia’s Consumer Data Right (CDR), featuring Business Consumer Disclosure Consent, significantly broaden the scope for financial data sharing, enhancing operational efficiency and financial management for businesses. The integration of these updates into the Basiq consent UI simplifies the data consent process, ensuring compliance while optimising user engagement. It enables service providers to offer more tailored solutions, streamlining operations and reinforcing trust in data sharing.

As open banking evolves, Basiq continues to innovate, empowering clients and their customers to maximise the value of their financial data.

Resources

Have a read of our developer documentation to understand how you can get started with BCDC.

Important Information: This article has been prepared by Basiq Pty Ltd (ABN 95 616 592 011) (Company), and was originally published on 12 April 2024 on www.basiq.io. Information is current as at the publication date, and the Company has no obligation to update or correct this article. The information contained in this article is of a general nature and is not intended to address the objectives or needs of any particular individual entity, and should not be regarded in any manner as advice. To the extent permitted by law, the Company and its related bodies corporate will not be liable for any errors, omissions, defects or misrepresentations in the information in this article or for any loss or damage suffered by persons who use or rely on such information (including for reasons of negligence, negligent misstatement or otherwise. © 2024 Basiq Pty Ltd