Artificial Intelligence (AI) is already having a significant impact on the way we do business today. From helpful chat bots guiding us through complex purchase journeys to detecting potentially fraudulent payments, AI has the potential to create seamless customer experiences while simultaneously processing large amounts of information.

Machine learning frees humans from the grunt work of data tracking and pattern analysis – it’s faster, more scalable and learns from past information. No wonder Gartner predicts that more than 40% of data science tasks will be automated by 2020.

So when it comes to balancing customer demand for real-time payments with secure fraud-mitigating authentication, AI is an effective enabling tool for fraud teams to focus their investigation skills in the best place to securely ensure the speed and rigour required for a real-time payment. And that’s why more organisations are exploring the use of AI, especially in the area of fraud.

What role could AI play in fraud prevention and detection?

Through machine learning, the complexity of big data really becomes useful. At Cuscal, we have partnered with Feedzai to provide an advanced risk management platform that will be core to protecting Cuscal clients from the evolving threat of fraud.

“When using Feedzai, banks have significantly improved fraud detection, reduced false positives and overall a better customer experience – outperforming leading non-AI solutions – that’s why banks like Citi and Capital One have backed Feedzai’s technology.” said Richard Harris, SVP Sales International from Feedzai.”

With so many more payment channels available – online, mobile, P2P – there are more points of vulnerability. More than ever, we need a complete view of customer activity across products, an integration of channels to improve the customer experience, and to make more data-backed business decisions.

How will AI strengthen existing fraud protection systems?

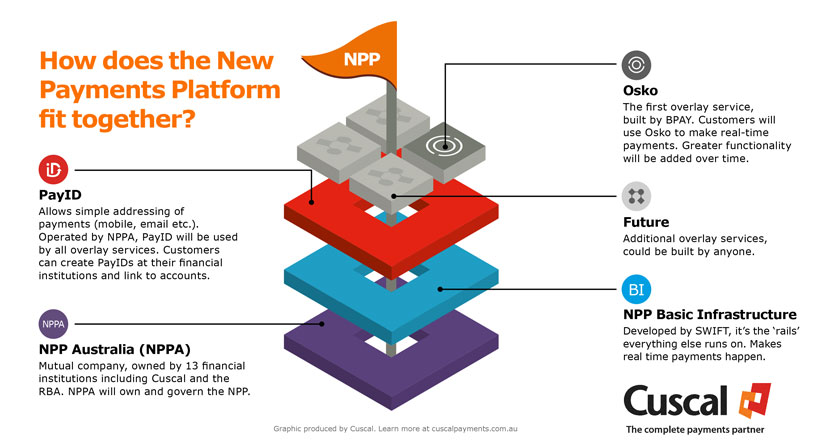

With AI’s ability to analyse complex data in real time, fraud teams are better equipped to predict fraud before it occurs and so minimise losses. AI reduces some of the noise of large amounts of data to focus on the real threats. As we prepare to launch the New Payments Platform (NPP) in Australia, we can expect to see digital transaction processing converge with analytics providing better insights. Machine learning will enable organisations to look at more data, from more sources, and make better predictions with less uncertainty.

Of course, bots could be working on both sides – and the next generation of AI-enabled fraud systems will also need to be prepared to tackle new and increasingly sophisticated fraud attempts and scams.

Every Australian financial institution connecting to the New Payments Platform (NPP) needs to consider their real-time fraud monitoring and ensure effective controls are in place. AI is likely to underpin best practice – checking every transaction in real time for anomalies and flagging suspicious activity for action by experienced fraud investigation teams.

Learn more about preventing fraud in a real-time world.

Fraud prevention: then and now

Learn more about preventing fraud in a real-time world.

By Michelle Trundle, Senior Manager, Fraud

The

The