The past couple of years have meant significant growth for non-bank lenders and there are no signs of slowing down, says Bronwyn Yam, the chief product officer at Cuscal.

According to the RBA, the sector grew on average 15 per cent on a six-month annualised basis, more than twice the rate recorded by banks.

It is an exciting – and competitive – time. And it is in this context that the non-bank lender sector prepares to be the next one rolling out the Consumer Data Right (CDR) in Australia. While some organisations try to understand how to best navigate this complex initiative, a key aspect may get lost amid the regulatory language: CDR is way more than compliance costs.

For those organisations willing to make this part of their digital transformation, the initiative presents opportunities to stay competitive, improve efficiency, enhance customer experiences, and drive innovation in the financial services sector.

As a partner of many banking and non-banking organisations, we’ve seen firsthand how data can improve an organisation’s ability to draw strategic insights for its business plans. The good news is that some implementations can be API-driven on a subscription basis, enabling users to securely share their data and empowering companies to build improved financial applications.

Here are key takeaways on how a well-implemented CDR solution can boost businesses.

- Improved customer experience: As an accredited organisation, non-bank lenders will have access to use consumer data to offer more tailored solutions. Companies that channel this supercharged data pool to drive innovation and product development will deliver improved customer experiences and personalised financial services – a potential make or break in a competitive environment. Easy wins include increasing conversion rates by fast-tracking your lending application process with a mobile-first experience, expedited approval times, quick account verification and pre-funds checks, and streamlined onboarding, easing the deposit of funds and progressing the lending cycle from origination to collections. And this is just the beginning of improved customer experience.

- Increased visibility of client movement: Non-bank lenders, as mandated data holders, should want access to the metadata generated by their existing customers sharing their data with other organisations. This new dataset becomes a source of powerful insights. At Cuscal, we call them a moat for our clients, protecting their businesses’ revenue and profit. The premise is that if companies use and analyse the data properly, they will notice trends or clients looking to move, allowing them to counteract with a better experience.

- More accurate risk management: While accessing data is a crucial step in developing a financial application, extracting insights from it truly unlocks its value. Adding comprehensive data overlay services helps companies harness the power of data to make more informed lending decisions, improve risk control, proactively manage hardship, and reduce default rates. Benefits include a deep understanding of spending behaviour with access to enriched transaction details, empowering non-bank lenders to improve their risk assessment capabilities.

- Increased cyber security: Maintaining robust cyber security practices helps build trust and confidence with your customers and assures them that their data is handled securely and responsibly. CDR also changes the game for consumers and businesses regarding cyber security. It is a safer solution than outdated methods, such as screen scraping, which require customers to share their login details with third parties (e.g. lenders and brokers) for the various compulsory checks for responsible lending obligations. Banning these insecure practices, such as sharing PDFs and scans of transaction statements, minimises the risks exposed by storing them.

- Compliance with standards and regulations is a key requirement for organisations participating in the CDR framework. That means non-bank lenders will automatically adhere to industry standards and guidelines to ensure data security, limiting exposure to malicious activity.

- Data protection measures include encryption, access controls, and secure data storage practices to safeguard sensitive information. The CDR framework also imposes ongoing monitoring and auditing of databases, securing consumer data by increasing the chances of discovering risks and losing integrity in datasets.

In summary, CDR is more than a compliance cost to non-bank lenders. It is the next step to increase business competitiveness and protect businesses and consumers in Australia. CDR is about giving consumers peace of mind when they transfer personal data online and giving them control over their vulnerable data.

As CDR continues to roll out, we anticipate a stronger, more protected ecosystem in which organisations, CDR solution partners, and customers are building collectively towards a safer digital economy.

There is much to learn from other industries in preparation for the legislation. However, the reality is that non-bank lenders should consider adopting CDR solutions regardless of the government timelines. CDR will be a reality and the sooner they can be ready and start benefiting from the advantages of data and insights to protect and boost their business, the greater value they will get for their investment.

By Bronwyn Yam, Chief Product Officer

This article was originally published on www.mortgagebusiness.com.au on 6 May 2024.

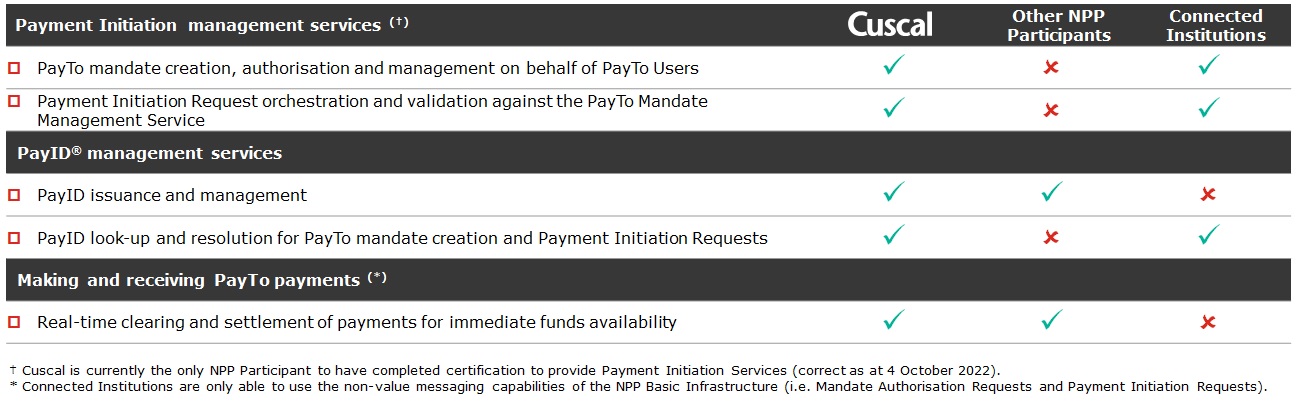

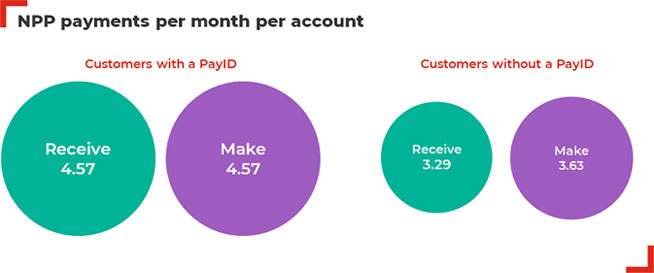

Figure 2: Cuscal NPP services compared to other directly connected participants

Figure 2: Cuscal NPP services compared to other directly connected participants

FinTech Australia Podcast Episode 018 with Cuscal’s Chief Client Officer, Bianca Bates and Tier One People’s Dexter Cousins talking about Cuscal and the journey the organisation has taken since the 1960’s. It turns out Cuscal is the oldest Fintech in town!

FinTech Australia Podcast Episode 018 with Cuscal’s Chief Client Officer, Bianca Bates and Tier One People’s Dexter Cousins talking about Cuscal and the journey the organisation has taken since the 1960’s. It turns out Cuscal is the oldest Fintech in town!