The economic, regulatory and technology landscape in banking and payments is constantly changing. This can lead some people to a kind of change fatigue, where each change is just another one for the pile. While this view is understandable, it can lead you to underestimate the impact of those changes which have much greater and longer-lasting impact. There is one change, coming soon, which will completely reshape banking and payments. I’m talking, of course, about Open Banking – the first application of the Consumer Data Right facilitating an economy-wide consumer-directed data transfer system.

What will this mean in terms of competition?

In the digital age there are heightened expectations about “experience” and how various elements of our life can be seamlessly integrated. An environment of open data, applied in a reciprocal manner, is essential to meeting these heightened expectations. Over time, we think that organisations that are unable to both facilitate and leverage open data will risk becoming irrelevant.

If you think about retail banking today, the ability to compete on product differentiation, price or distribution is very limited. Customer experience remains the greatest opportunity to compete.

This is one of the things that many of Cuscal’s banking clients do incredibly well and are rightfully proud of. However, the digital experience that their customers have has to be constantly improved and refined and the effective application of consumer data will be absolutely key to the future of their success in this area.

When is the right time to enable Open Banking?

It may be tempting to sit back and wait for more progress and certainty in relation to Open Banking and open data. I don’t think this approach is the right one for most financial institutions.

It’s going to be next to impossible to get the timing exactly right for Open Banking.

You will likely either be too early or too late in relation to Open Banking, so you will need to make a deliberate choice about which of these outcomes you want for your organisation.

If you decide to be early, it’s important to move on from compliance-type-thinking towards thinking about the opportunity to compete, enhance the relevance of your organisation and improve your relationship with your customers.

Collaboration will be the key.

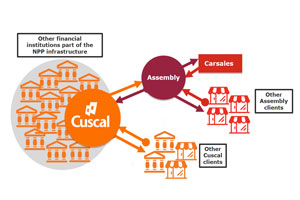

The nascent open data economy will be big, complex and uncertain. Exactly how things will develop over time is unclear. I don’t think any single organisation has all of the skills and resources needed to fully maximise this opportunity. Partnering with complementary organisations across the Open Banking value chain, to solve a specific problem or remove friction points, will be crucial to success.

There are a number of related developments that also need to be taken into consideration to create value for customers and enable safe and efficient access to data, such as digital ID, consent management, and the role that NPP may play in Open Banking and open data. We expect developments around open data to progress to payment initiation over time, as they have in other areas.

Just as we have done with the New Payments Platform and The Pays (Apple Pay, Google Pay and Samsung Pay) Cuscal will leverage our strengths across payments data exchange and the development of innovative customer-focused mobile solutions to enable clients to participate in Open Banking, providing support across multiple areas in the lead up to implementation and beyond.

To fulfil the ambition of the ACCC and Treasury of giving customers more control over their information, choice in their banking and convenience in managing their money we will provide clients and others with an opportunity to leverage economies of scale and multi-client solutions to interact with the open data economy.

We are at the beginning of an “always on” and “open data” world. Empowering people to take control, and maximise the utility of, their data will be the foundation of this future.

Read our white paper (published in collaboration with King & Wood Mallesons and KPMG) to find out more of our thinking.

By Craig Kennedy, Managing Director of Cuscal