Did you know that, according to a recent report from Xero, 25% of consumers would visit another business if their preferred payment method wasn’t available? These days, payments are more than just transactions – they are make-or-break moments for customer retention.

The importance of consumer-centred payment systems was a key theme at Cuscal’s Curious Thinkers 2024 event. The panel highlighted why businesses must rethink their payment systems to align with consumer expectations and offer seamless, secure, and flexible options.

Below, we explore the shifting landscape of consumer payments, why businesses must prioritise a consumer-centred approach, and steps they can take to enhance the payment experience for their customers.

Meeting Consumer Expectations: The Changing Payments Landscape

Consumers today expect more choice, transparency, and security in their payment interactions. The rise of digital wallets, real-time payments, and buy-now-pay-later (BNPL) solutions reflect this demand.

The report from Xero on how businesses and consumers are making and taking payments found that:

- 38% of consumers experience frustration when their preferred payment method isn’t available.

- 26% cite limited payment options as a reason for dissatisfaction.

- 25% would visit another business that accepts more payment methods.

These statistics underscore the need for businesses to offer diverse, frictionless payment options to meet evolving consumer expectations.

Beyond Transactions: Why Payment Experience Matters

Have you ever abandoned a purchase because the checkout process was too complicated or a payment option you preferred wasn’t available?

Payments are an essential touchpoint in the purchase process that can influence customer satisfaction and brand perception, for better or worse. Whether it’s a quick tap at a café or a major online purchase, a seamless payment experience can foster trust and build loyalty.

The rapid growth of e-commerce has been a major driver of this shift. Take Amazon, for example. Its one-click payment system revolutionised online shopping by eliminating unnecessary steps and reducing checkout friction. Similarly, Apple Pay and Google PayTM have redefined mobile transactions by allowing secure, instant payments with minimal effort.

Consumers accustomed to fast and frictionless online payments expect the same convenience across all channels. For businesses, this means:

- Delivering on speed and simplicity: Customers expect fast and intuitive transactions.

- Ensuring security and privacy to build trust: Clear authentication measures without unnecessary hurdles.

- Offering choice and flexibility: Multiple payment options to cater to different preferences.

- Managing complexity: Ensuring smooth integration and efficient backend systems while offering more payment options.

How Businesses Can Create Better Payment Experiences

Developing a consumer-centred payment system requires practical steps and thoughtful strategies. Below are recommendations from Cuscal’s Head of Payments & Innovation, Nathan Churchward, on how businesses can create a better payment experience for customers.

Know Your Customers, Meet Their Needs

Businesses must assess their customers’ behaviour and preferences to tailor payment solutions. Different demographics and business types have unique payment needs, so offering a one-size-fits-all solution may not be effective. Local payment providers can offer practical solutions to help businesses choose the best payment options for their customers.

Listening to consumer feedback is also key. Understanding and addressing pain points in the payment journey helps refine strategies, improve the experience, and build trust with customers.

Make Payments Effortless and Secure

A great payment experience should be both effortless and secure. Tokenisation helps by reducing the number of times customers need to enter their card details, making transactions smoother while keeping data safe. Digital wallets like Apple Pay simplify the process even further, allowing for fast, secure payments with a single tap. The best solutions remove friction and enhance security without adding extra steps.

Empower Customers Through Information

Customers feel more confident when they understand how different payment options work and what benefits they offer. Businesses that educate customers on their choices (especially when encouraging a preferred payment method) build trust and transparency.

If using surcharges to guide payment decisions, pairing them with clear explanations ensures customers see the value rather than just the cost. It’s also important to reassure customers about security, especially for prepaid services or payments made in advance, by highlighting measures in place to protect their funds.

Seamless Payments, Streamlined Experience

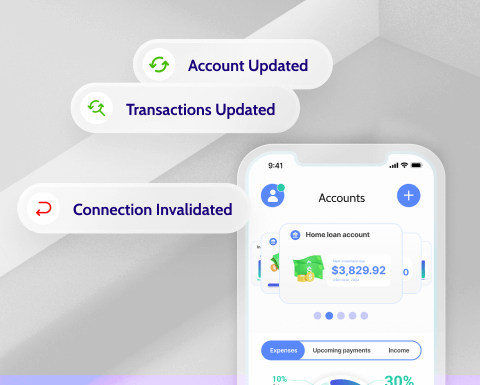

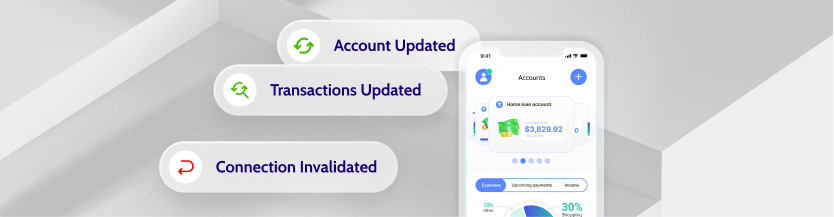

Payments should work in real-time and integrate seamlessly into business operations. Traditionally, card payments have led the way in integration and instant processing, but newer options like NPP and PayTo are catching up. The challenge has been ensuring these payment types update systems in real-time for smoother reconciliation and automation.

Businesses should seek payment providers that offer real-time payment APIs to maintain efficiency without compromise. PayTo, for example, enhances integration by eliminating the need for customers to manually enter details, allowing businesses to pass transaction data directly to the customer’s bank for easy authorisation. The right payment solutions should support automation, reduce manual processing, and improve the overall payment experience for both businesses and customers.

Prioritising Consumer Needs for Long-Term Success

A truly consumer-centred payment system goes beyond technology. It requires a deep understanding of customer behaviour, a commitment to security, and an effort to educate users. Businesses that align their payment strategies with consumer needs will enhance customer satisfaction and drive loyalty and long-term growth.

By investing in seamless, secure, and flexible payment solutions, businesses can transform payments from a transaction into a competitive advantage.

References

ANZ Subject Matter Experts 2024, ‘The digital payment revolution: what businesses need to know’, ANZ Insights website, article, 6 November 2024, article, accessed 17 February 2025, <https://www.anz.com/institutional/insights/articles/2024-10/the-digital-payment-revolution>

ANZ Worldline 2024, ‘Why Chief Market Officers should prioritise their payment strategy Part I’, ANZ Worldline website, article, 9 September 2022, accessed 17 February 2025, <https://anzworldline.com.au/en/home/knowledge-hub/blogs/why-chief-market-officers-should-prioritise-their-payment-strate>

Xero 2024, ‘I want to pay that way’, Xero website, report, 2024, accessed 17 February 2025, <http://www.xero.com/campaign/i-want-to-pay-that-way>

Knowledge at Wharton Staff 2017, ‘Why Amazon’s ‘1-Click’ Ordering Was a Game Changer’, Knowledge at Wharton website, podcast and article, 14 September 2017, accessed 11 March 2025, <https://knowledge.wharton.upenn.edu/podcast/knowledge-at-wharton-podcast/amazons-1-click-goes-off-patent>

Google Pay is a trademark of Google LLC.

Apple Pay is a trademark of Apple Inc., registered in the U.S. and other countries.

Important Information: Information in this article is current as at 14 March 2025 and is subject to change. This article is provided for general information purposes only and does not have regard to the situation or needs of any reader and must not be relied upon as advice. Before acting on this information, consider its appropriateness to your business Cuscal Limited ABN 95 087 822 455.

Figure 2: Cuscal NPP services compared to other directly connected participants

Figure 2: Cuscal NPP services compared to other directly connected participants