Real-time payments just got a whole lot realer with the two public-facing brands of the New Payments Platform announced today. Adrian Lovney, CEO of NPP Australia Limited, revealed in a recent interview that the first thing consumers are likely to notice when the service goes live is their bank inviting them to register for a PayID. The other new financial brand consumers can expect to see from October is Osko. With this combined public release of the Osko and PayID brands, financial institutions participating in the New Payments Platform can begin to think of the ways Australian consumers will soon interact with these affiliated brands via their personal banking experience.

The announcement of Osko and PayID raises a number of questions important to both the industry and, in time, the end user. In particular, I was curious to know how PayID and Osko relate to one another and, perhaps more importantly, why do we need both brands in the first place?

Well, the industry has known for some time that BPAY’s overlay service was chosen as the first to be used in the New Payments Platform. It was identified as the initial way to showcase the New Payments Platform’s capabilities in as early as October 2015. The service’s brand promise has been well articulated from the outset: to provide businesses and consumers with an immediate, versatile and data-rich service to complete their everyday payments. The difference now is we know its public name: Osko.

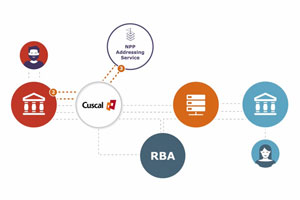

How then does PayID fit within this scheme – how does it feature and what does it do that Osko cannot? Put simply, PayID is the brand name of the centralised addressing service that will enable direct funds transfer in an unprecedentedly personal and convenient, yet secure way. But this still leaves some wondering, how will it all work? PayID will work by linking financial accounts with recognisable and memorable pieces of information such as your phone number or email address. This will eliminate the need to select or re-enter bank account numbers without putting the security of your banking details and other information at risk.

Where then does PayID sit within the brand hierarchy of the New Payments Platform? There’s an easy way to conceive this, which is that PayID is the brand for the addressing service that can and will be used to power Osko (and other overlay services down the track too). In other words, PayID will store smart addresses for payments but Osko is the hero brand, for the first overlay service anyway, which everyone is going to use to make real-time P2P payments conveniently and securely.

It’s early days yet but I wonder what can be made of the two brand names. In particular, the first time I heard Osko, it struck me as slightly unusual. Then I considered the names of other leading brands and how they were first received when they launched in the market. Google and Uber, for example, are two brands that have achieved universal resonance, yet they probably didn’t mean anything to you at first. They certainly didn’t for me. Now, however, we find that in our thirst for knowledge in a digital age, we no longer search for something – instead, we Google it. Equally, rather than riding in a hired vehicle to get us from A to B, we simply Uber it.

While my predictive powers are not strong enough to pinpoint the ways (or precisely when) Australian consumers will begin to use Osko and PayID synonymously with making an instant payment, I think we’ve lived through enough examples which show how this might happen. When BPAY developed the Osko brand in conjunction with brand and marketing specialists, feedback from the test groups was very positive. In the time that I have used the new name in conversation, which has been for a little while now, it has really grown on me. It seems to be hitting the mark with others too.

What will really work in Osko’s favour is the open invitation it has created for BPAY and financial institutions to collaboratively shape its meaning. This reflects BPAY’s intention for Osko to be a blank canvas that allows industry participants to co-create the meaning of the new brand in the lead up to its launch.

I expect that this approach to building its brand identity will increase buzz and drive discussion around the new value it creates for Australian consumers. When I consider the New Payments Platform in its broadest context, I am mindful that up until now it has often been talked about in terms which highlight the revolutionary nature of its service.

While this is not misleading, there is another, simpler lens through which we can understand the New Payments Platform and its two public brands now that they have been released, which is that they will collectively close a current gap in the Australian payments ecosystem – the gap being our lack of a simple, convenient service available 24/7 for individuals and businesses to request and receive payments without having to disclose their personal banking details.

By Nathan Churchward, Senior Manager, Payments