As we jump feet first into 2016, RFi Group had the pleasure of sitting down with Ashley Williams, Cuscal’s Senior Manager – Digital, and someone right in the Cuscal workroom, to discuss progression in the mobile banking and payments apps space and what the latest is when it comes to digital wallets.

As we jump feet first into 2016, RFi Group had the pleasure of sitting down with Ashley Williams, Cuscal’s Senior Manager – Digital, and someone right in the Cuscal workroom, to discuss progression in the mobile banking and payments apps space and what the latest is when it comes to digital wallets.

As General Manager of Product & Service at Cuscal Adrian Lovney stated in a LinkedIn Pulse Post early this year, 2016 is set to be the year mobile wallets go mainstream in Australia.

The announcement just before Christmas that Android Pay will arrive in Australia in early 2016 is big news for payments, but it’s also another significant step that’s slowly, but inevitably, taking mobile payments from niche to mainstream. There has been a lot of chatter about mobile wallets being the future of payments in Australia, but so far we haven’t seen many people actually use their mobile phones as wallets. 2016 is looking like the year that will change this.

RFi Group met with Ashley who went on to explain Cuscal’s sharp focus on providing superlative technical integration for their customers and are currently nothing short of delighted to be experiencing such a huge take up for the new product. With 41 of their clients signing up to The Pays for day one, the figures are accounting for roughly 90% of their card volume.

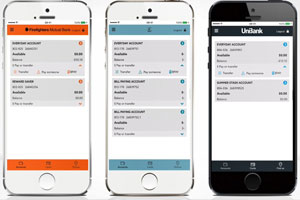

Providing these solutions for our clients means that the work we do for them now, puts them in a key position to be able to launch into other wallets as soon as they’re available. We are focused on that technical build, creating and facilitating the links into the schemes (specifically Mastercard, Visa and eftpos) and then into the three different wallet providers (Google, Apple and Android) – meaning phones can in effect become a digital wallet.

As well as managing the technical integration and back end ‘maze’ of complexity this project brings, Cuscal will be providing customers with marketing toolkits and training support to guide them through the adverting process.

And to help, they have some pretty stellar partners –

We’re collaborating with Google to ensure the campaigns are consistent across the market and offer a seamless customer experience. In terms of Cuscal itself, all 41 of our clients will be out in the market promoting and marketing from day one.

With all this change, we wondered, what can customers expect? Ashley is frank but fair –

Obviously mobile banking apps with contactless payments have been around for some time, and the payments part of the equation isn’t something new, what we do believe is going to change is the market awareness and public’s perception of payments – it is really set to shift dramatically.

Ashley goes on to cite the key differences for the Android Pay launch, compared to the way Australian financial institutions launched their mobile wallets in dribs and drabs. There is a clear plan to wait until everyone is ready and “all the ducks are in a row”, before they go live. “From a market perspective, it will be a huge coordinated push.” She says.

The concept and launch of the digital wallet itself, Ashley explains, is when things will get interesting. Cuscal’s view is that the ecosystem will change as pay providers (Google, Apple and Samsung) begin to partner with merchants and the in-out purchasing becomes a big component of the wallet. The loyalty of that ‘front of wallet’ card provider will move it from purely a transactional product, to an all-encompassing solution.

Other benefits lie, perhaps unsurprisingly, in data.

Because of the richness of the data we can receive, Cuscal’s FI customers will have full exposure to behaviour and trends of their card holders. They will have access to information such as default card choice or individual selection of card, which will deliver great insight to a bank regarding what their customers are doing.

This all provides banks with more information than they have ever had before and therefore the ability to reach out to their customers about card choice or behaviours. Other advantages can be found in the origination process of Android Pay. If a customer doesn’t have a banks mobile banking app, the functionality will prompt them to register. Again, providing yet another way for banks to increase the amount of customers they have using their banking app.

Ashley thinks this increased functionality is likely to take mobile payments to the masses.

With increased advertising and marketing from Google, as well as almost every Australian FI encouraging people to use these new offerings, the shift to mobile payments as the major, if not one day, sole, channel, is inevitable.

It is a huge shift, but we are at a stage now that it is not about acceptance, but more so, customer preference. It will need to work and it will need to work consistently, but we expect customer take-up to be rapid.

If it is in fact to become a comprehensive digital “wallet”, Cuscal sees the need for other parties to get one board and quickly. As seen in the UK, the rise in mobile tap and pay payments since its integration with transport for London’s Oyster network, was exponential. If case studies such as this are anything to go by, it is obvious that with the inclusion of an individual’s drivers licence, Opal/ Myki (travel) card, Medicare card, health insurance card, could really begin to speed things up and quickly. As Ashley quickly points out, the payments piece is only one component.

Ashley closes noting that Cuscal is in fact in a unique position compared to other affiliate parties.

“We are not just one institution, we are representing so many. Essentially we have 41 individual projects running seamlessly and in many ways, in conjunction, which is a huge achievement. For us to be able to match the market and to be there for day one of the launch, mobilising teams so quickly, is exciting and we really feel like it is going to make a huge impact.”

This article first appeared in the March 2015 edition of RFi Group’s Australian Retail Banker (which is no longer available on their website).

As we jump feet first into 2016, RFi Group had the pleasure of sitting down with Ashley Williams, Cuscal’s Senior Manager – Digital, and someone right in the Cuscal workroom, to discuss progression in the mobile banking and payments apps space and what the latest is when it comes to digital wallets.

As we jump feet first into 2016, RFi Group had the pleasure of sitting down with Ashley Williams, Cuscal’s Senior Manager – Digital, and someone right in the Cuscal workroom, to discuss progression in the mobile banking and payments apps space and what the latest is when it comes to digital wallets.