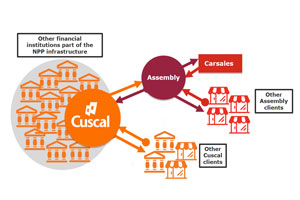

We have been thrilled by the reaction to the recent article which broke the news about the New Payments Platform (NPP) collaboration between Cuscal and Assembly Payments. We’ve both been fielding lots of enquiries from companies keen to emulate Carsales and so we thought we’d write this article to tell you a bit more about how the collaboration works and the best way to bring the benefits of real-time payments to your customers.

We think the NPP is a fantastic opportunity for any e-commerce company that is sending large amounts of money around or just needs to move money fast. Whether this is large volumes of transactions (or just large transactions) the benefits are clear – immediate, verified payments with detailed descriptions will enhance customer experience and minimise enquiries.

What is the NPP and how do you connect?

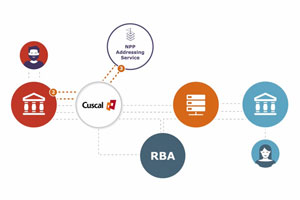

The NPP is the new, decentralised payments infrastructure which allows participating financial institutions (including Cuscal and the RBA) to move money between each other in seconds, 24/7. To become part of the infrastructure (a ‘Participant’) is a lengthy, complex process and you are required to be an Authorised Deposit-taking Institution (as it’s a regulated environment and requires access to RBA settlement facilities). However, most companies don’t need to do this. They can get the same benefits, more cheaply and easily by connecting to one of the Participants.

What levels of connection and capability are there?

The second official level of connection to the NPP is called an ‘Identified Institution’. The collaboration between Cuscal and Assembly Payments is big news because Assembly is the first company that is NOT a financial institution to be officially recognised as an Identified Institution. This means Assembly can register and create PayIDs for others and offer NPP services to its own customers, like Carsales.

Complicated? It doesn’t have to be.

While the background, and some of the terms, are a bit complicated, actually using the NPP is getting easier. Most companies will connect through APIs. The New Payments Platform has recently published its API framework which enables third parties to get a greater understanding of the platform and what it can do, using a sample API Sandbox.

Each NPP Participant will support their own APIs based on the NPP API Framework. Cuscal has already released REST APIs, which is how Assembly accesses NPP and Osko services to move money in real-time between Cuscal and other financial institutions.

Using the NPP is even quicker and easier for those companies that don’t need to become an NPP Identified Institution but want the benefits that come with NPP and Osko payments. For example, Carsales is enabled for NPP services through the Assembly platform.

Which path is right for you?

It depends on what you want to do.

- Talk to Cuscal if you want to become an Identified Institution, like Assembly, and offer PayIDs and NPP services to your own customers. This path will suit businesses such as financial institutions and payment service providers.

- Talk to Assembly if you would like a full suite of multi-channel payment solutions including real time NPP payments, PayIDs, underwriting, fraud and KYC services. This path will suit many online businesses, especially corporate enterprises, marketplaces and ecommerce platforms.

If you’re confused as to which path is right for you, just get in touch with either one of us and we’ll steer you in the right direction!

By Nathan Churchward, Cuscal and Simon Lee, Assembly Payments